GIS systems and geospatial data analytics continue to evolve and find increasingly diverse applications, including within the realm of business. These technologies are instrumental in enabling companies to expand their horizons, unearth new market opportunities, deliver superior services to their clientele, and secure a distinctive competitive edge.

In this article, we will delve into the real- world applications of spatial intelligence and explore the full spectrum of possibilities brought by Globema’s GeoGrid GIS system within the insurance industry.

Challenges of the insurance industry – accurate risk assessment

Assessing risks for insured properties is one of the main challenges of the insurance industry. This is a key process, as it determines the rates of insurance policies, which translate into the insurer’s potential losses in the event of a claim.

Risks are affected by many parameters, among them those based on location: the distance from a flood zone, an aviation danger zone, tornado paths, the proximity of a fire station, etc.

What is location intelligence?

Location intelligence, or geointelligence, is a field of data analytics that focuses on using geographic and spatial information to make better business and operational decisions. It involves the collection, analysis, visualization, and interpretation of location-related data to gain insights into various aspects of an organization’s operations. With location intelligence, organizations can better understand their environment, identify new business opportunities, optimize processes, and make more informed decisions

GeoGrid GIS system and its role in insurance risk assesment

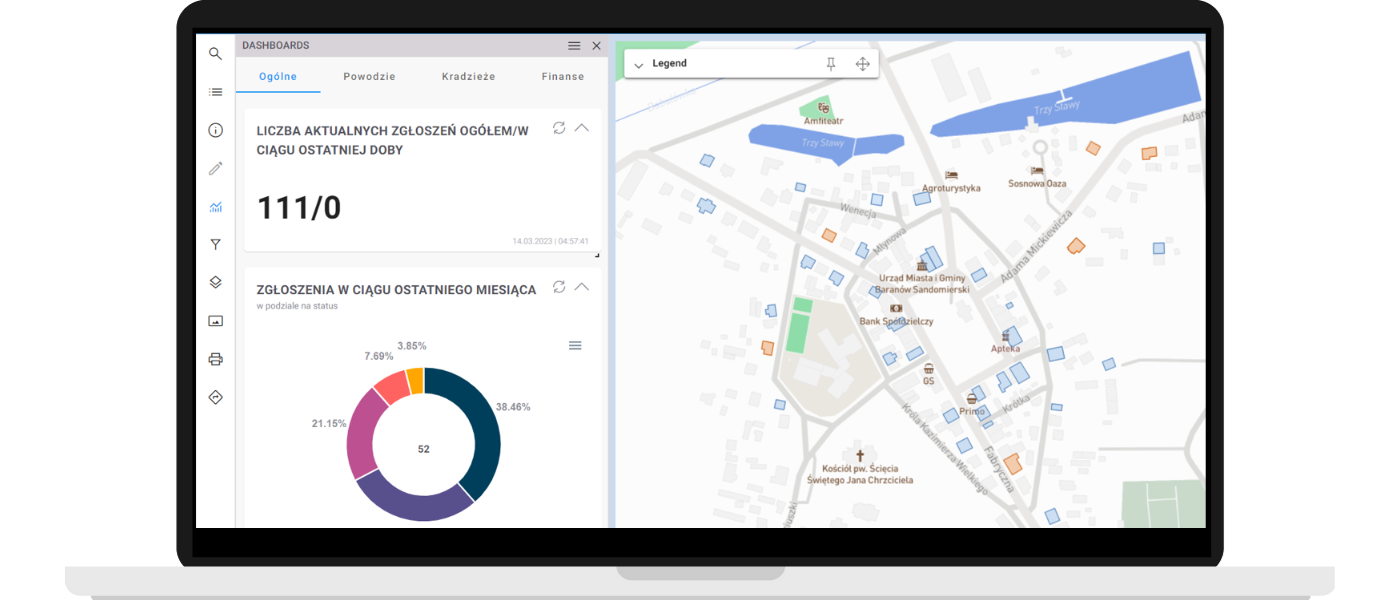

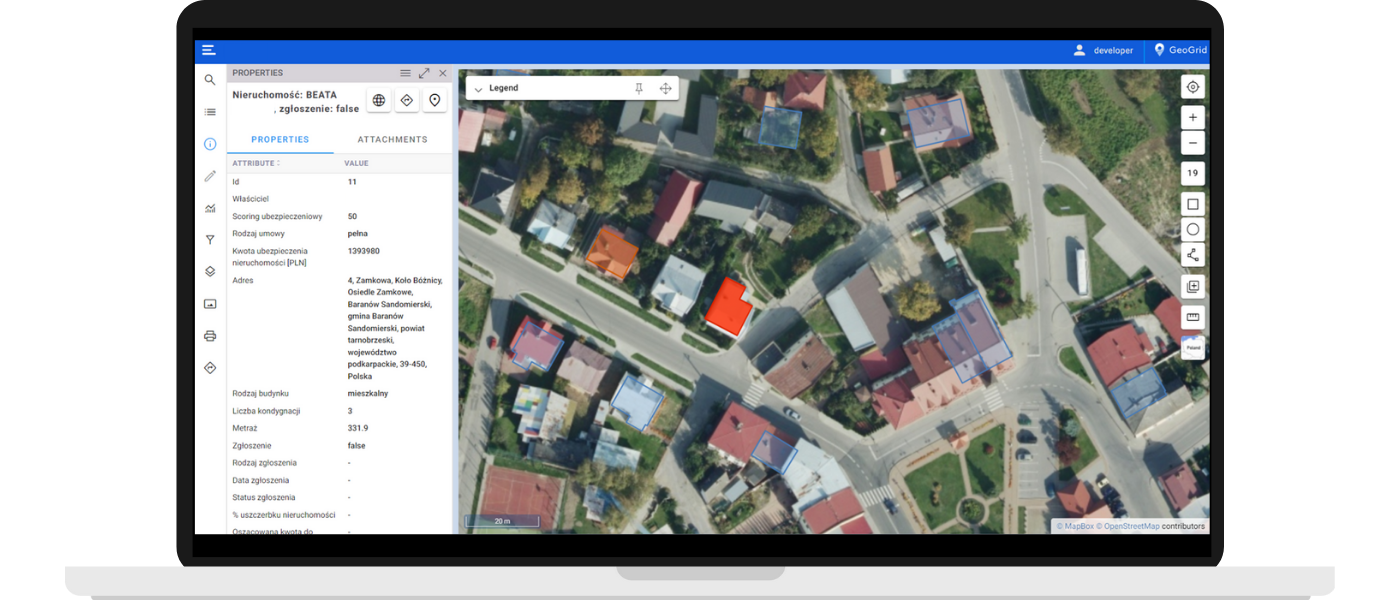

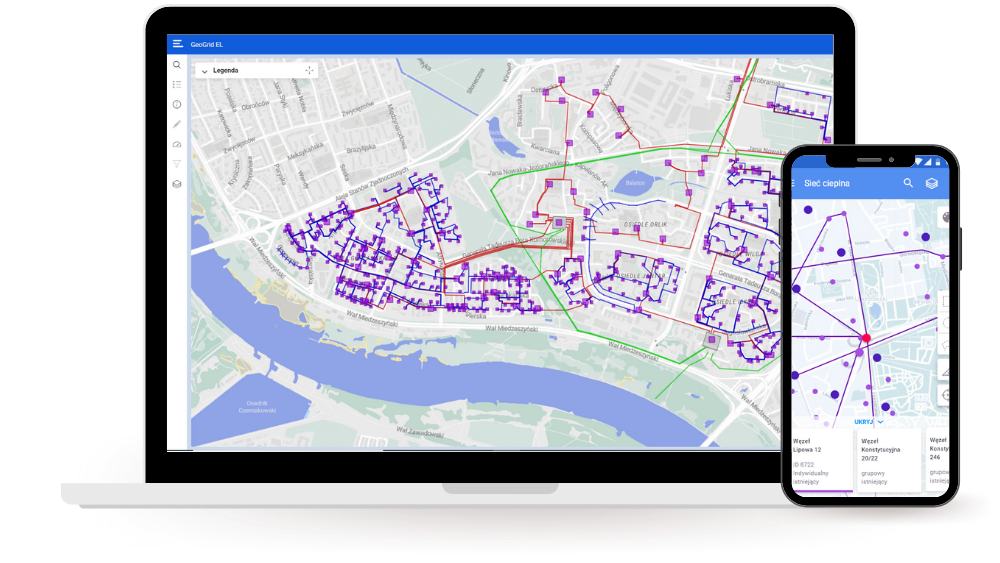

GeoGrid is an advanced spatial data management system that allows you to put asset elements on a map and perform detailed analysis of objects and data in a geographic context.

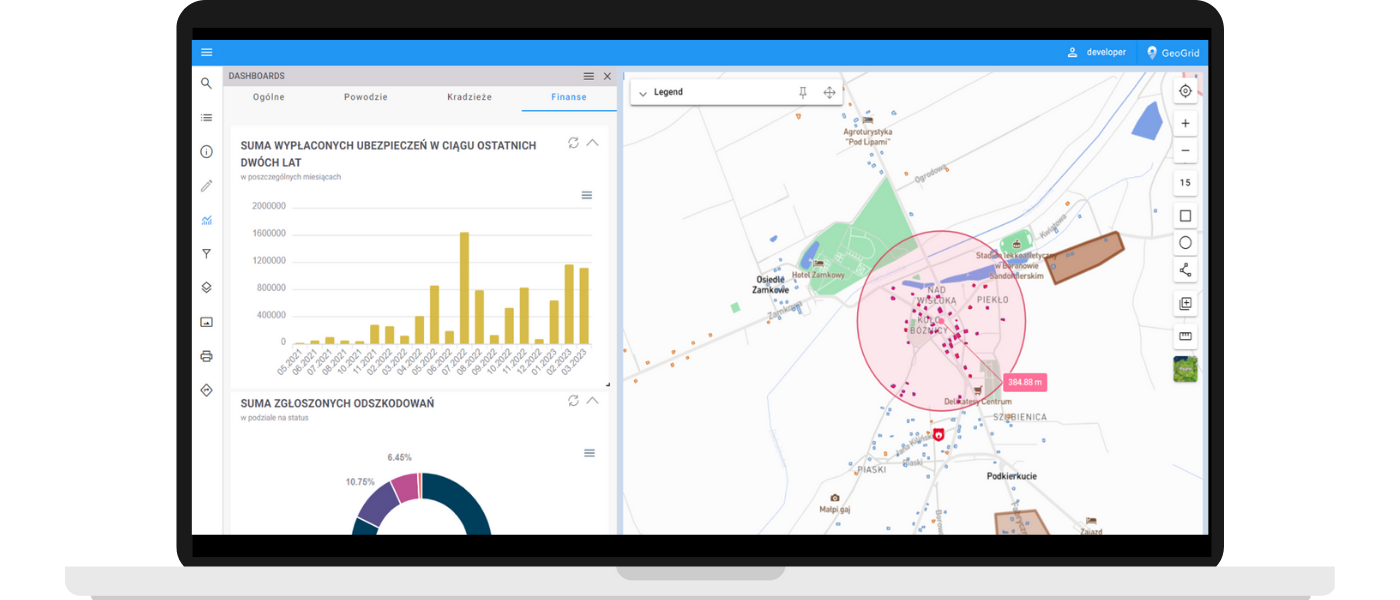

It gives you the ability to present on a map all the factors that an insurance agent must take into account when performing risk assessment (determining insurance scoring) needed to calculate policy premiums and determine policy coverage.

So, on separate layers on the map, we have a visualization of the location of the property and specific factors that affect the insurance scoring, such as:

- The extent of floodplains – how far is the property situated from floodplains and how likely is it that it will be affected by floods?

- The aircraft approach zone – is the building is located in an air danger zone?

- Paths of tornadoes or areas of strong winds – is the building is within their range?

- Distance from the property to the nearest fire station – how quickly can the fire department arrive in case of a fire? Does it have to cross a railroad crossing that can increase the time of arrival?

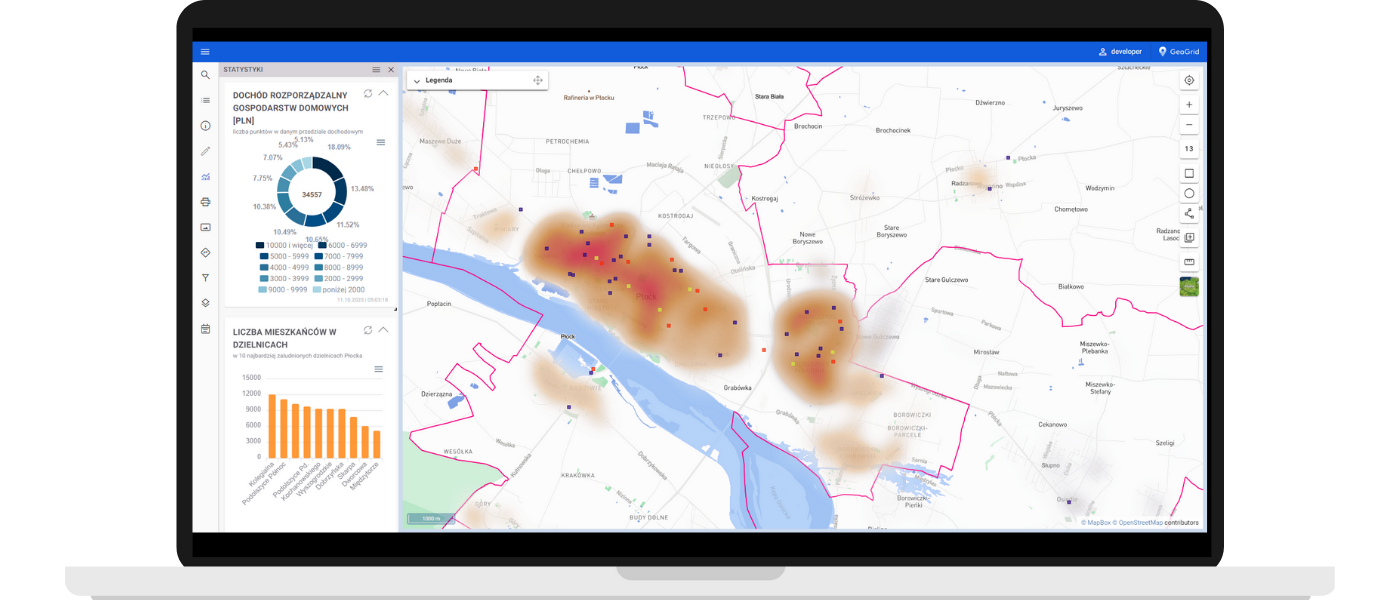

This information can be supplemented, for example, with demographic data (average income of residents, crime rate, etc.).

By visualizing all key data on a map, risk assesment becomes easier and with a much lower probability of error.

In addition, thanks to its integration with the FME data integration Platform, the GeoGrid application enables advanced geospatial analyses, which allows the user to calculate the insurance scoring even more precisely, and quickly generate reports.

How can the employees of an insurance company use GeoGrid in their daily work?

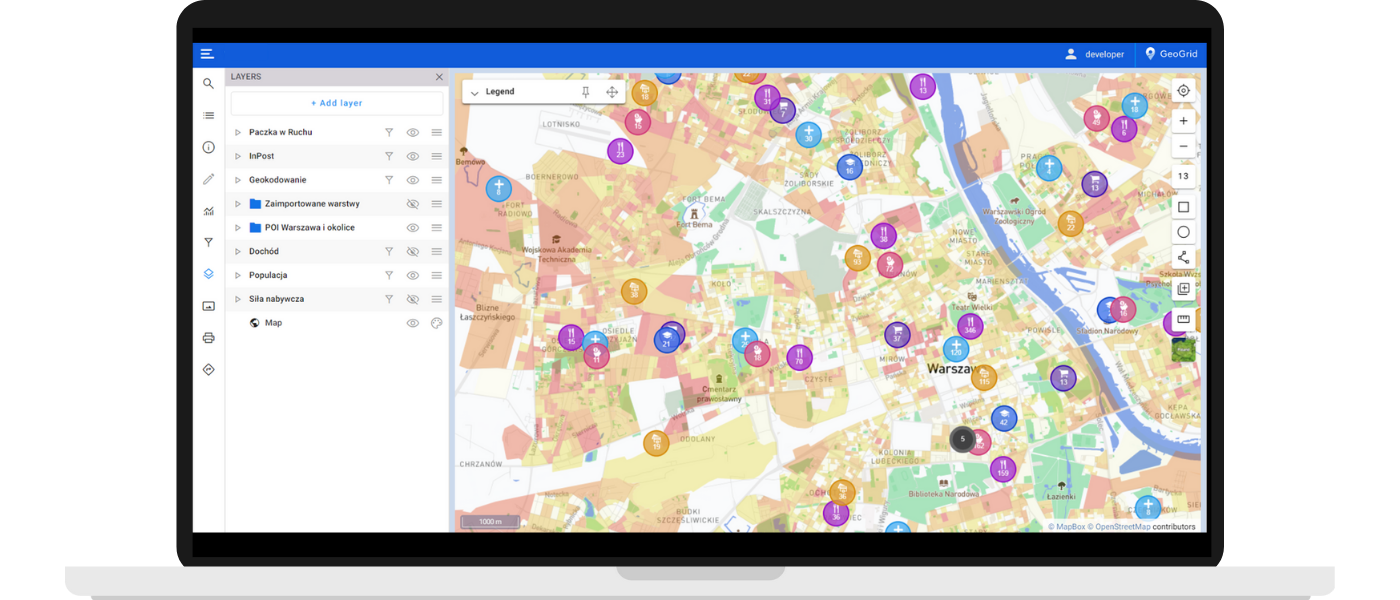

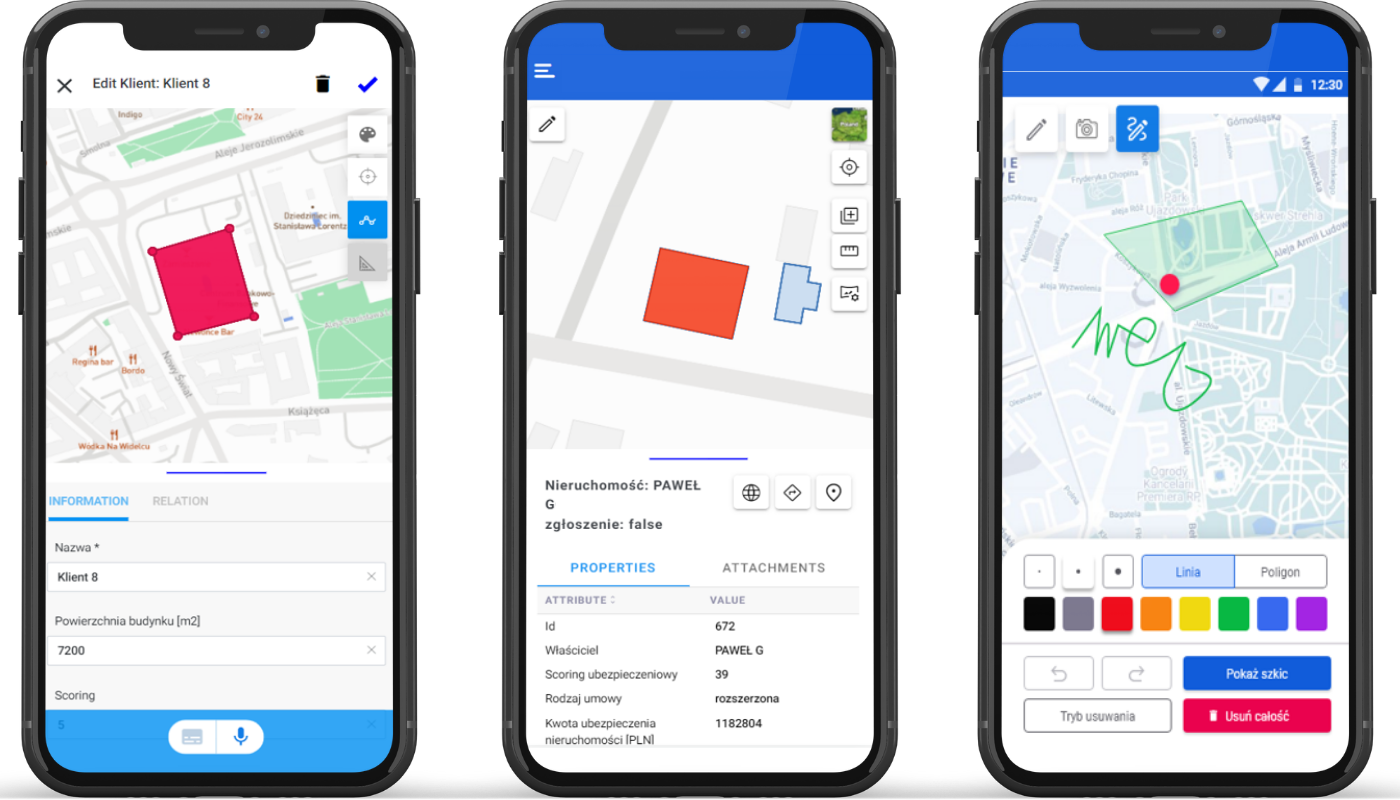

GeoGrid is a web and mobile application that gives users access to all key data on insured properties in one place, which they can further use to create analysis or prepare quotes.

Field crew members:

- Can collect data on properties in the field using the mobile app. This data is then made available for use by other members of the company.

- They can draw and parameterize buildings and other objects on a map.

Office workers who create insurance quotes:

- Can display geospatial data in the form of data layers, such as flood areas or hazard zones.

- Can use GeoGrid to analyze the data and calculate the risk factor associated with a particular building or facility. Based on these analyses, insurance quotes for corporate clients will be developed.

Both in-office and field workers can easily upload new geospatial data or update data that is already in the system. They don’t need any advanced GIS knowledge to do so.

What benefits does GeoGrid bring to the insurance sector?

Find out if Geogrid will be a good match for your organization

GeoGrid is a tool that can revolutionize the way you manage spatial data and analyze risk. Our system helps you to make better, more informed, decisions.

For more information about the system, visit the GeoGrid website:

If you have more questions, need additional information, are interested in using GeoGrid in your organization, you are welcome to contact us.